APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

Australia: L’Oreal dazzles with star-studded event and new brand ambassador

L’Oreal is Australia’s Biggest Brand Mover for April.

The cosmetics giant made gains in eight out of 13 BrandIndex metrics, in the Media and Communication category (Aided Brand Awareness, Ad Awareness, WOM Exposure), Brand Perception category (General Impression, Quality) and Purchase Funnel category (Consideration, Purchase Intent, Current Customer).

L’Oreal recently invited beauty personalities and media figures to a launch event in Sydney, where it presented an array of new cosmetics, skincare and haircare products. The beauty label also earlier unveiled Manchester City and national footballer Mary Fowler as its new brand ambassador, who will partner with the brand on various women’s empowerment initiatives and product launches in Australia and New Zealand.

Suzuki is the runner-up, with the auto maker scoring upticks in eight metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Skype takes third place, with the telecommunications provider also seeing improvements in seven metrics across all three categories.

Video gaming console maker Xbox and Italian food products brand Bertolli round out the top five, making gains in six metrics each.

Singapore: Gardens by the Bay scores with Sakura display

Gardens by the Bay is Singapore’s Biggest Brand Mover for April.

The horticultural attraction made gains in eight out of 13 BrandIndex metrics, in the Media and Communication category (Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration).

Gardens by the Bay recently organised the ninth edition of its Sakura floral display from 22 March to 21 April, where visitors to the garden’s Flower Dome can experience a day-to-night cherry blossom viewing experience for the first time. This year’s display also featured a replica of the iconic Kinkakuji Temple in Japan’s city of Kyoto, which also visitors to step into the structure and imagine themselves inside the UNESCO World Heritage site.

Zalora is the runner-up, with the fashion retailer scoring upticks in eight metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Malaysia Airlines takes third place, with the flag carrier seeing improvements in six metrics across the Brand Perception and Purchase Funnel categories.

Meta’s Facebook and Google’s YouTube round out the top five, making gains in five and four metrics respectively.

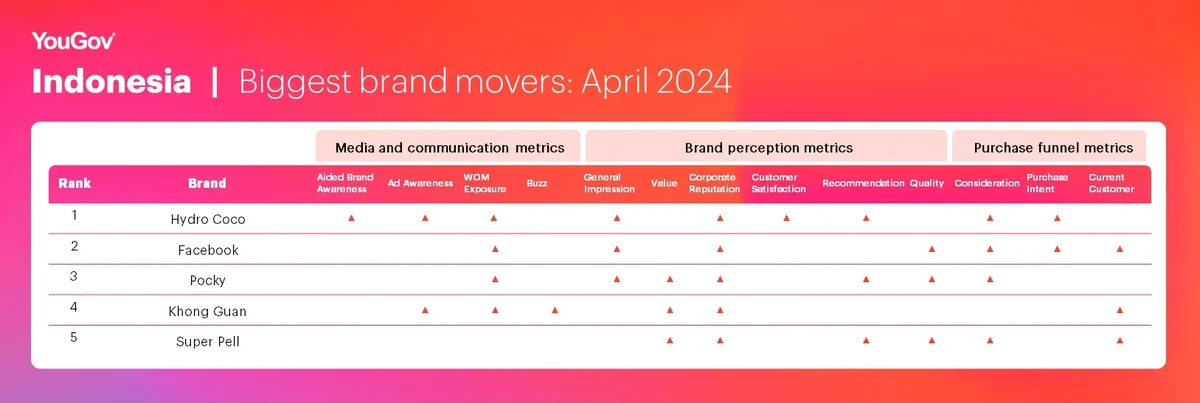

Indonesia: Hydro Coco savors success with Insta challenge

Hydro Coco is Indonesia’s Biggest Brand Mover for April.

The coconut water brand made gains in nine out of 13 BrandIndex metrics, in the Media and Communication category (Aided Brand Awareness, Ad Awareness, WOM Exposure), Brand Perception category (General Impression, Corporate Reputation, Customer Satisfaction, Recommendation) and Purchase Funnel category (Consideration, Purchase Intent).

The beverage maker recently ran a social media campaign, where it invited netizens to follow their Instagram page, interact with the brand’s posts, and post an IG story featuring its product. Participants stood a chance at being one of twenty winners to win 100,000 rupiah Ovo and Go-Pay prizes.

Facebook is the runner-up, with the social media platform scoring upticks in seven metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Pocky takes third place, with the Glico-owned snack brand seeing improvements in seven metrics across all three categories as well.

Biscuit maker Khong Guan and Unilever’s floor cleaner brand Super Pell round out the top five, making gains in six metrics each.

Was your brand one of APAC’s Biggest Movers in April?

Uncover the other brands that were among the top ten in Australia, Singapore and Indonesia by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for April 2024 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including China, Hong Kong, Indonesia, Japan, Malaysia, Philippines, Thailand and Vietnam? Contact us and sign up for a free brand health check today!

Methodology

Biggest Brand Movers for April 2024 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between March and April 2024.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time