Australia: Supercheap Auto revs to first place with racecar film

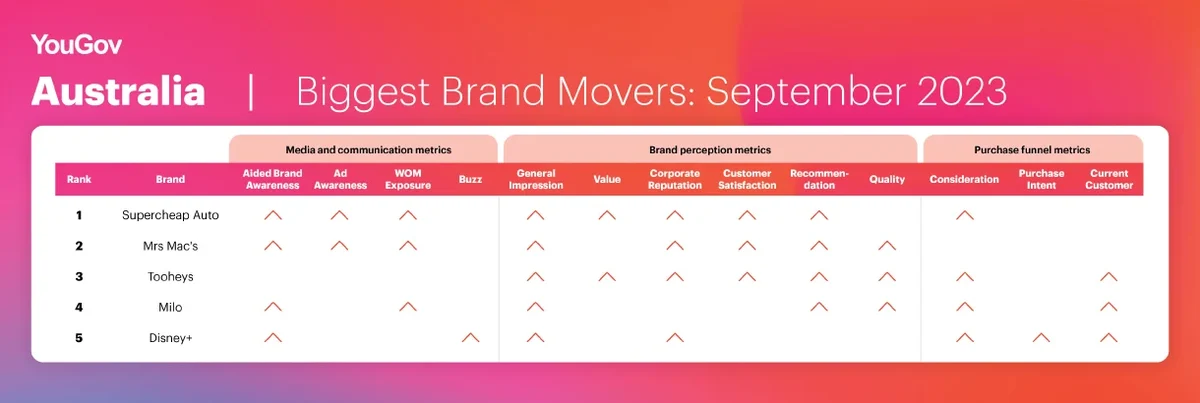

Supercheap Auto is Australia’s Biggest Brand Mover for September.

The automotive parts and accessories retailer made gains in 9 out of 13 YouGov BrandIndex metrics, in the Media and Communication category (Aided Brand Awareness, Ad Awareness, WOM Exposure), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation) and Purchase Funnel category (Consideration).

In early September, Supercheap Auto released a seven-minute film titled “Retirement Rampage” in which five motorsports drivers – Chaz Mostert, Molly Taylor, Matt Mingay, James Moffatt and David Reynolds – racing in high-performance cars to get to a bingo game on time, was released in early September as part of Supercheap Auto’s latest campaign to encourage automotive owners to keep their vehicles running in top condition by regularly checking and changing their engine oil.

Fuel brands sold by Supercheap Auto – including Nulon, Penrite, Valvoline, Mobil and Castrol – appear as podium finishers in the film, which also features Aussie TV personality and racing enthusiast Grant Denyer plus Australian motorbike racer Daniel Sanders.

Mrs Mac’s is the runner-up, with the meat pie brand scoring upticks in eight metrics across the Media and Communication plus Brand Perception categories. Tooheys takes third place, with the brewery seeing improvements in eight metrics across the Brand Perception and Purchase Funnel categories.

Chocolate-flavoured malt beverage brand Milo and OTT streaming service Disney+ round out the top five, making gains in seven metrics each.

Singapore: Pantene top of table with supermarket chain discounts

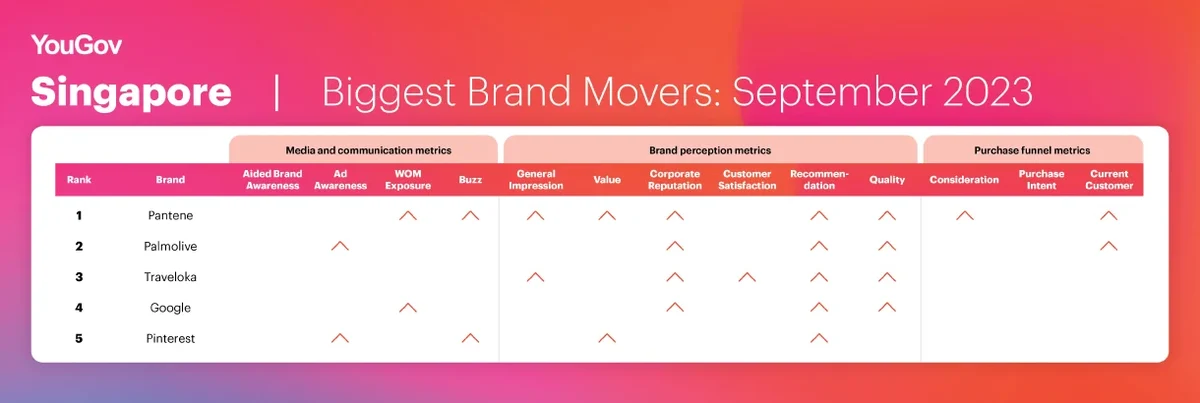

Pantene is Singapore’s Biggest Brand Mover for September.

The mobile wallet made gains in nine out of 13 YouGov BrandIndex metrics, in the Media and Communication category (WOM Exposure, Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Recommendation, Quality) and Purchase Funnel category (Consideration, Current Customer).

Supermarket chain NTUC FairPrice recently ran a series of promotions on Pantene daily moisture and hair fall control conditioners.

Palmolive is the runner-up, with the personal care brand scoring upticks in five metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Traveloka takes third place, with the online travel booking platform seeing improvements in five metrics in the Brand Perception category.

Tech giant Google and image sharing site Pinterest round out the top five, making gains in four metrics each.

Thailand: Fun-O leads with 7-Eleven promo

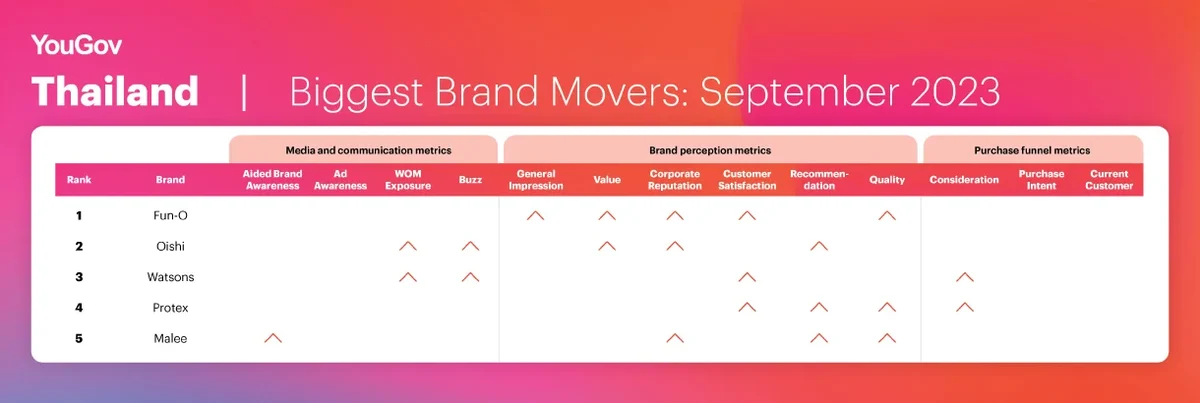

Fun-O is Thailand’s Biggest Brand Mover for September.

The Universal Robina-owned brand made gains in five out of 13 YouGov BrandIndex metrics, in the Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Quality).

Convenience store chain 7-Eleven recently ran a week-long buy-two-get-one-free promotion for the sandwich cookie brand, which comes in 11 different flavours, in early September.

Oishi is the runner-up, with the Japanese restaurant chain scoring upticks in five metrics in the Media and Communication plus Brand Perception categories. Watsons takes third place, with the health and beauty retail chain seeing improvements in four metrics across the Media and Communication, Brand Perception and Purchase Funnel categories.

Soap brand Protex and packaged food brand Malee round out the top five, making gains in four metrics each.

Was your brand one of APAC’s Biggest Movers in September?

Uncover the other brands that were among the top ten in Australia, Singapore and Thailand

by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for September 2023 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including China, Hong Kong, Indonesia, Japan, Malaysia, Philippines, and Vietnam? Contact us and sign up for a free brand health check today!

Methodology

Biggest Brand Movers for September 2023 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between August and September 2023.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time