How the fashion retailer took over Singaporean wardrobes

Japanese retailer Uniqlo has become a household name. Since launching in Singapore twenty years ago, the franchise has grown to 27 stores island-wide –more than one store opening per year. Singapore is even home to the brand’s first Global Flagship Store.

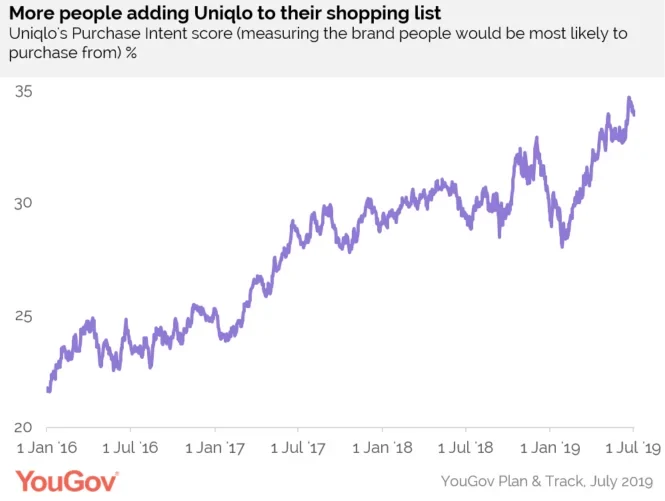

From the time that YouGov Plan & Track began tracking it, there’s been a significant increase in Uniqlo’s Purchase Intent score – which measures the brands people would be most likely to buy from. On 1 Jan 2016 this stood at 23.5, but has since risen steadily to a score of 35.6 currently, a rise of +12.1 points, indicating that more Singaporeans are adding it to their main shopping destinations.

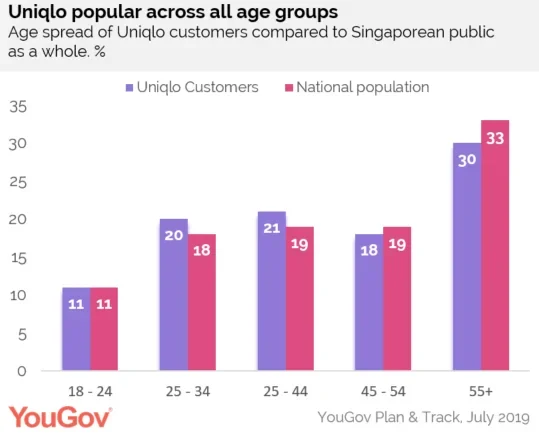

Uniqlo’s popularity stretches across all age groups. This can be seen by comparing its customer base to the national population of Singapore. The brand is particularly popular among those aged 25 to 34. Demographically, a typical Uniqlo customer is female, Chinese, working full-time and have a monthly household income of SGD 6,000 to 7,999.

However, what makes Uniqlo stand out from other high-street fashion brands is its perceived quality. The brand has a much healthier Quality score (44.3) compared to competitors like H&M (13.1) and Cotton On (-0.9).

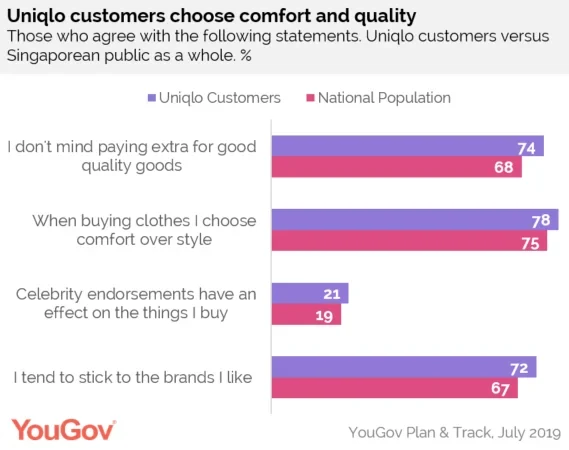

Indeed, three quarters (74%) of Uniqlo customers ‘don’t mind paying extra for good quality goods’, compared to two thirds (68%) of the general population. Furthermore, its customers care about comfort, with 78% of its customers choosing comfort over style when buying clothing compared to 75% of the general population.

It has also been clever with its advertising. The brand boasts tennis superstar Roger Federer as its Global Brand Ambassador, running ads where he showcases their ‘LifeWear’ clothing – a range that emphasises quality and comfort. This looks like a smart move by Uniqlo, as its customers are more likely than the general population to be influenced by celebrity endorsements (21% vs 19%).

The challenge for Uniqlo will be to stay relevant in a highly competitive high-street fashion market. A quarter (24%) of its customers also shop at H&M and two in ten (21%) shop at Cotton On. However, our data also suggests it has loyal customers, with people who buy Uniqlo being more likely that the population as a whole to stick to the brands they like (72% vs 67%).

Ervin Ha, Head of Data Products for YouGov APAC commented: “The success of Uniqlo in Singapore is something that retailers will be looking to replicate, which is what makes the brand such a good case study. While Uniqlo clearly have an in-depth understanding of customer preferences and behaviour, their ability to appeal across age groups boils down to a common denominator – a preference for quality clothing. We will be observing the brand to see how it continues to maintain favour as new brands crop up on the market, and customers’ tastes continuously evolve.”